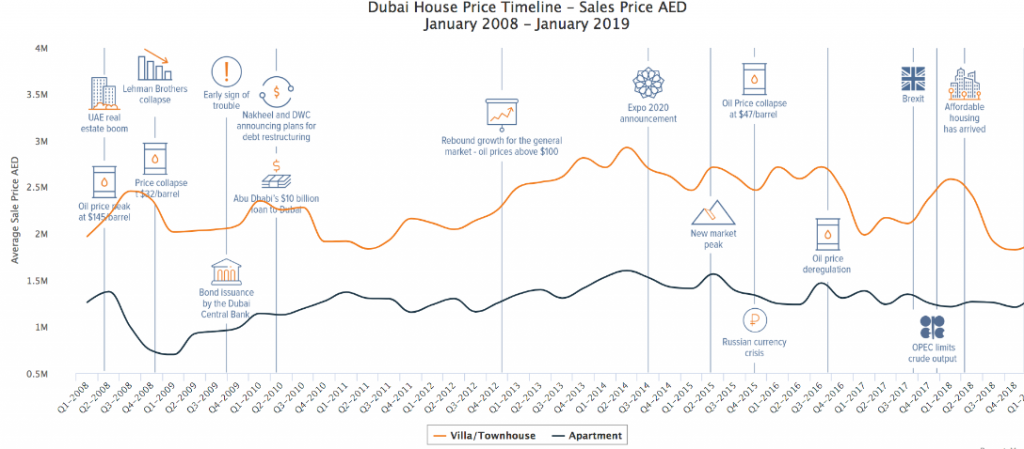

We present you the history of price changes in the Dubai real estate market from 2009 to 2019. It’s Propertyfinder’s latest report that offer to learn from mistakes and forecasts the future through analyzing the past.

Real Estate in Dubai has had a tremendous ups and downs since the Q2 2008 boom, when oil prices were at their peak of $145 per barrel. The average property sale price across Dubai was then AED2,197,956 for villas/townhouses and AED1,375,068 for apartments, according to official findings from DLD.

2009 saw the collapse of oil prices to just $32 per barrel and major banks around the World closed down and billions of US dollars were lost globally in all sectors. Dubai, unfortunately, was also affected, particularly by the lack of investment into the real estate sector, when villa/townhouses decreased in price by over 8% in 12 months and apartments average price across Dubai dropped down to AED698,280.

By Q1 of 2010, the market started to show signs of recovery with 63% increase in the average apartment sales prices and a 16.6% increase in the average villa sale, which fact could also have had place due to the title deed registration implementation right around this time.

The market remained pretty stable and developers started to release multiple off plan projects over the next 5 years.

From the beginning of 2010 property prices started to increase again, and in Q2, 2015, the average of villa/townhouses got 13.3% more expensive and apartments rose in price by average 37%. All in all 2015 average prices of all transferred residential property surpassed pre-crash prices (Q1 2008).

Apartments have experienced a steady drop in prices from Q4, 2016 until bottoming out through to the beginning of 2019. Villa/townhouses prices dropped at the beginning of 2016 but saw a 9 month peak until dropping in Q4 of 2018 to an average sale price of AED1,825,843.

To summarise the above is a rough timeline to show how quickly the Dubai market recovers and stabilises, but these figures represent all of Dubai, different areas have seen different results. The figures are also influenced by the early 2010's registrations of Oqood, Off Plan Registrations and, most importantly, supply and demand in the Emirate.

The total number of apartments and villas/townhouses transacted at the Dubai Land Department from 2010-2018.

- 2010 - 26,774

- 2011 - 22,008

- 2012 - 29,231

- 2013 - 41,777

- 2014 - 40,739

- 2015 - 30,748

- 2016 - 32,685

- 2017 - 40,701

- 2018 - 34,878

According to Propertyfinder, market will largely remain stable in developed communities for 2019, strongly dependant on there being no further supply of property on the market, we should see an increase in prices within the next 18 - 24 months.

Follow the changes in the Dubai property market by subscribing to the newsletter from IMEX Real Estate, and buy/sell or rent/lease real estate in Dubai with the qualifieed help of our experts. Our contacts:

Tel. in Dubai, UAE: +971 (50) 2528188 (Whatsapp, Viber, Telegram)

Toll Free Dubai: 800-IMEX (800-4639)

IMEX REAL ESTATE BROKER LLC, UAE

Office 2502, Marina Plaza, Dubai Marina, Dubai, UAE

Email: pm@IMEXre.com

Skype: resident69