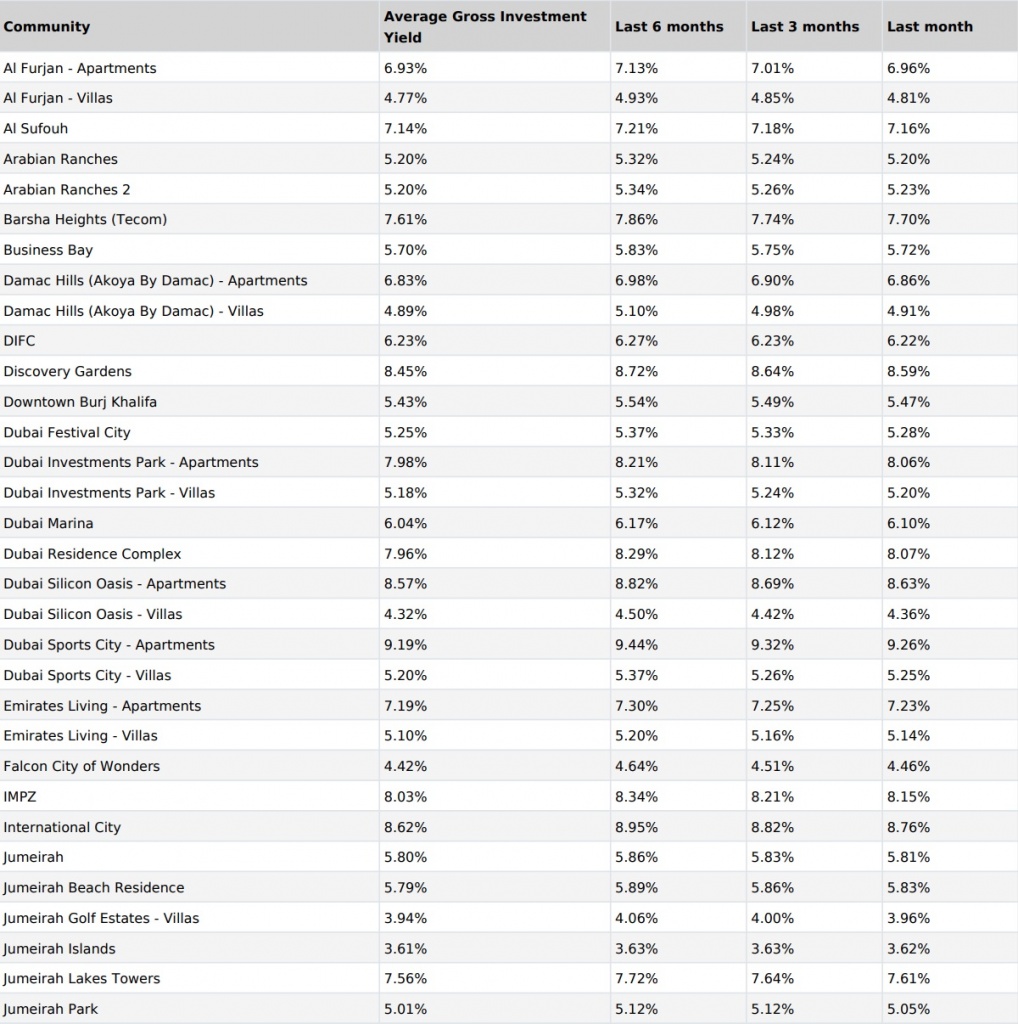

We’ve made an overview of the average RoI by areas in Dubai over the past six months based on reliable market sources. See below the table of average investment yields for 3-6 months, and for the last month as well.

According to our findings, a great change in prices for both leasing and sales transactions in the Dubai property market was recorded over the last 2 to 3 years, basically as the result of the supply/demand ratio changes.

Return on investment has always been a big selling factor for property in the region. Most global cities, such as London, New York, Sydney etc. can offer only about 2-4% net returns, but Dubai has always seen a minimum of 7% and above for most properties, which factor stays the major for investors attracted to the emirate.

Dubai also can offer more benefits due to low maintenance costs, as the majority of the buildings are new. And high demand set rather high rents from the very beginning few years back, with service charges in the most of communities staying relatively reasonable for what you get for your money (i.e. swimming pools, gyms, security etc).

The good news is that returns on investments still remain high, and although they have seen a drop in some communities, they are still the highest globally for single residential properties investments (not through an investment company or developers offering guaranteed hands-off investment return).

And so that you could better navigate in the sea of property investment offers in different areas of Dubai, we have prepared for you a detailed overview of the average return on investment by areas, based on the latest data revealed by Propertymonitor. See below the Table of Average Gross Investment Yields by communities and by different time periods ranging from six months to last month.

The Index, which Propertymonitor gives to each community, is based on sales prices and rental rates in each master development based on reliable market evidence, which is then scrutinised rigorously using the company’s market expertise. Sales prices and rentals in different buildings in the same community can also differ greatly depending on amenities and facilities available and other factors, such as the size and number of bedrooms in certain units, as well as the views and the neighbourhood. Thus, Propertyfinder tracks maximum number of buildings and factors in each community to make the Index the most accurate. This includes per sq.ft. rates, as well as the total sales/rental price per unit for standard units within selected communities.

If you are looking to sell, buy, lease or rent a property please contact IMEX Real Estate on:

Tel.: +7 903 232 80 80 Oleg Lavrik (Whatsapp, Viber, Telegram)

Tel. UAE: +971 (50) 2528188

Toll Free in Dubai: 800-IMEX (800-4639)

IMEX REAL ESTATE BROKER LLC, UAE

Office 2502, Marina Plaza, Dubai Marina, Dubai, UAE

Email: pm@IMEXre.com

Skype: resident69